The R&D tax credit is a federal and state credit (credits for states vary from state to state) designed to stimulate research and development activity of US companies by reducing their after-tax cost. Companies that qualify for the credit can deduct 20 percent of qualified research expenditures above a base amount from their corporate income taxes.

History of the R&D Tax Credit

The R&D tax credit (known previously as Research and Experimentation or R&E) was instituted in 1981 as part of the Economic Recovery Tax Act. The credit was created as an incentive for US companies to maintain their technological competitiveness. However, due to extremely strict requirements and the high threshold of innovation only large corporations were able to utilize the credit (Guenther 2005).

In 2001, President Bush and his administration reviewed the utilization of the credit and discovered that small and mid-size companies were not taking advantage of the credit. This prompted a change in the regulations that removed the high threshold of innovation and allowed the threshold of innovation to be relative to the individual company and not the industry (Rivera 2011).

In 2008, Congress passed The Emergency Economic Stabilization Act of 2008 which retroactively extended the credit and increased the Alternative Simplified Credit rate to 14 percent.

Until 2010, the credit could only offset the difference between regular tax and Alternative Minimum Tax (AMT). For taxpayers that were in AMT, the credit had to be carried back one year or carried forward for up to 20 years to offset future tax liabilities. In 2010, President Obama signed into law the Small Business Jobs Act of 2010 which eliminated the 2010 AMT restrictions on sole proprietorships, partnerships and non-publicly traded corporations with $50 million or less in average annual gross receipts for the prior three years (Titan Armor 2010).

This new law allows businesses to carry unused credits back five years.

Who Can Benefit from the Credit?

There are a host of industries that typically qualify for the credit. Some examples are:

- Electronic Manufacturing

- Textile Manufacturing

- Software Development

- Graphic Designing

- Food and Drug Manufacturing

- Pharmaceuticals

- Biological Treatment

- Water Treatment

- Food Processing

- Cosmetic Development

- Aerospace

These are just a few examples of companies that could qualify, but many more may take advantage of this opportunity.

What Qualifies as Research?

Under IRC §174, the IRS utilizes a “Four-Part Test” to define qualified research.

Part I: Permitted Purpose

The activity must relate to new or improved business components in one or more of the following areas:

- Function

- Performance

- Reliability

- Quality

Part II: Technological in Nature

The activity performed must fundamentally rely on the principles of:

-

Physical science

-

Biological science

-

Computer science

-

Engineering

Part III: Elimination of Uncertainty

The activity must be intended to discover information to eliminate uncertainty concerning the capability or method for developing or improving a product or process, or the appropriateness of the product design.

Part IV: Process of Experimentation

Substantially all the activities must be elements of a process of experimentation involving:

-

Evaluation of alternatives

-

Confirmation of hypotheses through trial and error, testing and/or modeling

-

Refining or discarding of hypotheses

What are Qualified Research Expenses (QRE)?

Qualified Research Expenses are outlined under IRC §41(b)(1) as amounts paid or incurred by the taxpayer during the taxable year in carrying on a trade or business relating to: (1) in-house research and (2) contract research. In-house research is the sum of all amounts paid or incurred for wages, supplies, and amounts paid or incurred to another person for the right to use computers to conduct qualified research.

Any wages paid or incurred to an employee in the performance of qualified research activities can be included in the credit computation. The term "wages" generally holds the same meaning as provided under IRC §3401 (base wages, direct bonuses, nonqualified stock options, etc.). If an employee performs both qualified and non-qualified activities, only the qualified wages will be considered. The appropriate method of apportioning wages to the qualified activities is multiplying an employee's total wages for the year by a fraction, with the numerator consisting of the annual qualified activity hours and the denominator representing total annual hours worked in all activities. If the above apportionment calculation shows that the employee's qualifying percentage is at least 80%, then all of the employee's wages for the year will qualify for the credit computation.

Qualifying services, which are required in determining wage payments available for the credit include the services engaged in qualifying research, direct supervision of qualified research activities, and direct support of qualified research activities.

Supplies are defined as any tangible personal property (other than land, improvements, or property subject to the allowance for depreciation) directly used in the performance of qualified research.

Any contract research paid or incurred by the taxpayer to another person, excluding employees of the taxpayer, to perform qualified research for the taxpayer qualifies for the credit. 65% of contract research expenses are considered QRE.

The summation of qualified wages, supplies, and contract expenses is referred to as total “qualified research expenditures” or “QRE”.

The Calculation Methods

There are two standard methods of calculating the §41 credit and an alternative method the company may elect. The first option is the “regular credit”, which consists of two basic components:

- 20% of the excess (or increase) in QRE for the current year over a base period amount, plus

- 20% of the excess (or increase) of "basic research payments" (or "university basic research payments") made in the current year over a base amount paid to universities and other qualified organizations. The base amount is the average of the prior three years’ payments for “basic research” to qualified organizations.

The second option is the reduced credit. For tax years beginning after 1988, taxpayers who select the “regular credit” method are required to reduce their deductible research and development expenses under IRC §174 expense deduction (or capitalization). The election is made at any time prior to or on a timely filed (including extension) income tax return. The election is made on Form 6765. Once made, the election is irrevocable for that particular tax year and will allow the taxpayer to reduce the credit in lieu of being required to add back the credit to taxable income.

The "base period amount” is defined in IRC §41(c) as the product of:

- The fixed-base percentage and

- The taxpayer's average annual gross receipts for the four tax years preceding the taxable year for which the credit is being determined.

The "base period amount", however, can never be below 50% of the current year's qualified research expenditures. Therefore, the "base period amount" (used to compare the incremental increase in qualifying expenditures for credit computational purposes) will always be the greater of: (1) the computed amount under IRC §41(c) or (2) 50% of the current qualifying expenses.

Another option is the Alternative Simplified Credit (ASC). Since 2007, taxpayers have been able to elect the ASC, which equals 14% (for tax years beginning on or after Jan. 1, 2009 and 12% previously) of the QRE’s for the taxable year that exceed 50% of the average QRE’s for the three taxable years preceding the credit determination year. If the taxpayer has no QRE’s in any one of the three preceding tax years, the ASC rate equals 6% of the QRE’s for the credit determination year. The election to claim the ASC must be made on the original tax return and cannot be made retroactively.

Alternative Simplified Credit (ASC):

ASC = (QRE – Average of Previous 3 Years QRE x 50%) x 14%

Regular Credit:

20% (Current QRE – Base Period Amount) + 20% (Current payments to University – Base Period Amount) = R&D Credit

If the special election is made under IRC §280C(c) (3), the amount of the allowable credit is determined as follows:

Reduced Credit:

Allowed Research Credit = (QRE – Base Period Amount) x 13%

Base Period Amount:

Base Period Amount = Fixed-Base % x Average of Prev. 4 yrs GR

Fixed-Based Percentage Computation

For tax years beginning before January 1, 1994, the fixed-based percentage is a flat 3%.

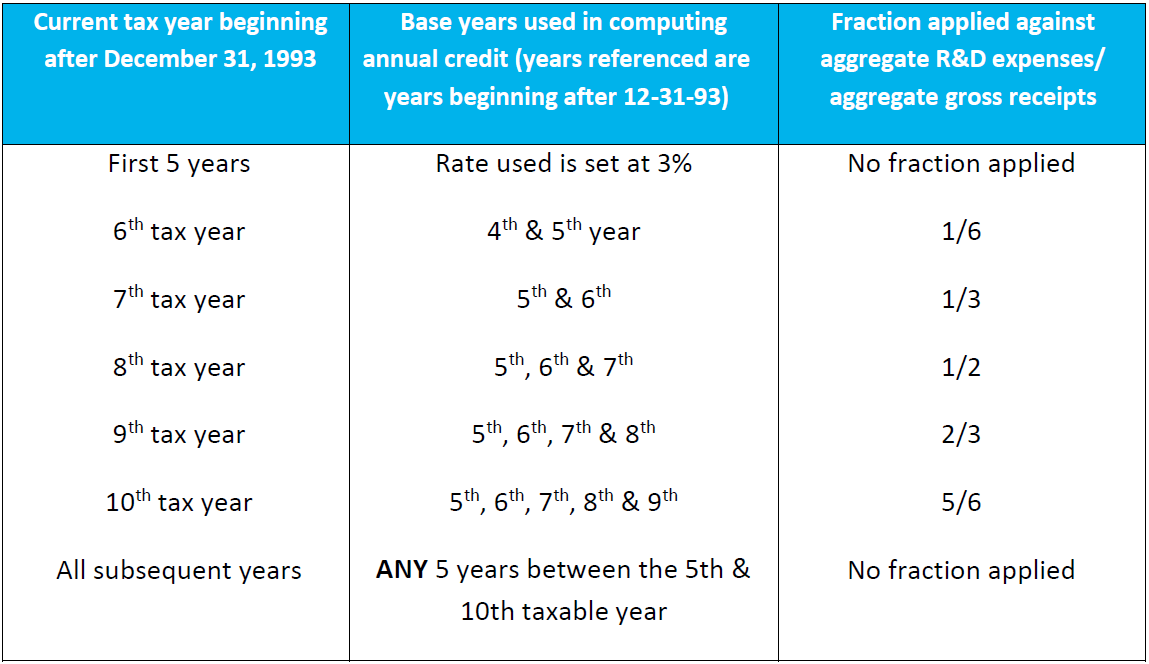

For tax years after December 31, 1993, the following table details the fixed-based percentage computation:

Note: Fixed-base percentage cannot exceed 16%

Product Development Life Cycle

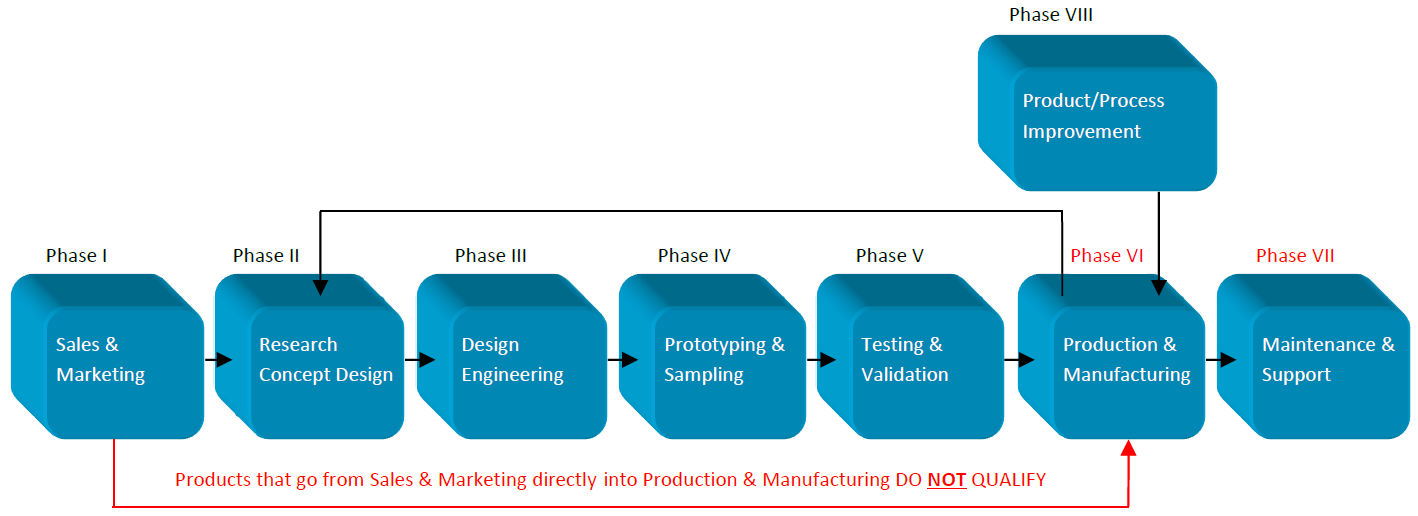

The flowchart above displays the typical product development cycle that a qualified research and development product goes through.

Phase I: First an idea or need is developed in the sales and marketing phase. The need can be internally driven or externally driven by the customer.

Phase II: Once the need is developed, the development team begins to research concepts, designs, and feasibility. During this phase the developers build several hypotheses.

Phase III: Once a product concept is deemed feasible, the developers begin the experimentation phase by creating the researched concepts.

Phase IV: After the design is engineered, the development team typically builds prototypes or samples so that further testing can be conducted prior to production.

Phase V: During the testing and validation phase, the product goes through series of testing as the developers look to ensure that all uncertainties have been eliminated.

Phase VI: Once the product has passed all validation testing, the research and development is complete and the product is ready to be manufactured.

Phase VII: During the maintenance and support phase, companies typically provide customer with routine product support. This phase does not include any new or improved attributes developed for existing products.

Phase VIII: When a company decides to enhance a product or process that is in production and sends it back through Phase II through Phase V, these expenditures may qualify toward the credit.

Qualified expenditures in Phase I through Phase V may qualify toward the R&D credit; however once a product enters production, it is no longer qualified research and development. If an improvement to functionality, quality, reliability, or performance is introduced and the product goes through this life cycle to answer the “Four-Part Test”, the research expenditures may qualify until that product or process goes back into production. If a product goes from the sale and marketing phase directly into production, it does NOT qualify as research and development for purposes of the tax credit.

Exclusions

Certain activities, which appear to meet the above requirements, may still be statutorily excluded from qualified research. Following are the statutory exclusions. If the answers to any of these exclusions are yes, then the activities do not qualify (IRS 2008).

- Research after commercial production - "Was any research conducted after the beginning of commercial production of the business component?"

- Adaptation of existing components - "Was any research related to the adaptation of any existing business component to a particular customer requirement or need?"

- Duplication of existing business component - "Was any research related to the production of an existing business component (in whole or in part) from the physical examination of the business component itself or from plans, blueprints, detail specifications, or publicly available information with respect to such business component?"

- Surveys, studies etc. - "Was research related to any efficiency survey, activity relating to management technique, market research, testing, or development (including advertising and promotions)?"

- Computer Software – Computer software developed by or for the company primarily for internal use will only qualify if (a) the computer software is created for use in an activity which constitutes qualified research, (b) the computer software is created for use in a production process, or (c) the computer software meets three specific internal use software tests. In order to meet the three specific internal use software tests, the software must be innovative, created at significant economic risk and not commercially available.

- Foreign research - "Was any research conducted outside the United States?"

- Social Sciences, etc. - "Was any research in the social sciences, arts, or humanities?"

- Funded research - "Was any research to the extent funded by any grant, contract, or otherwise by another person?"

Example Credit CalculationS:

Regular Credit for Startup (Years 1 – 5)